A Financially Confident You Begins Here.

One thing veterans have in common is the experience of unique financial opportunities and challenges. On your journey to becoming more financially stable, having a trusted resource and community that meets you where you are and gives practical, easy-to-implement tips and strategies is a complete game changer. Enter Veteran Saves: your savings accountability partner. Join our community for support with saving successfully, reducing debt, building wealth, and more.

Take the Veteran Saves pledge

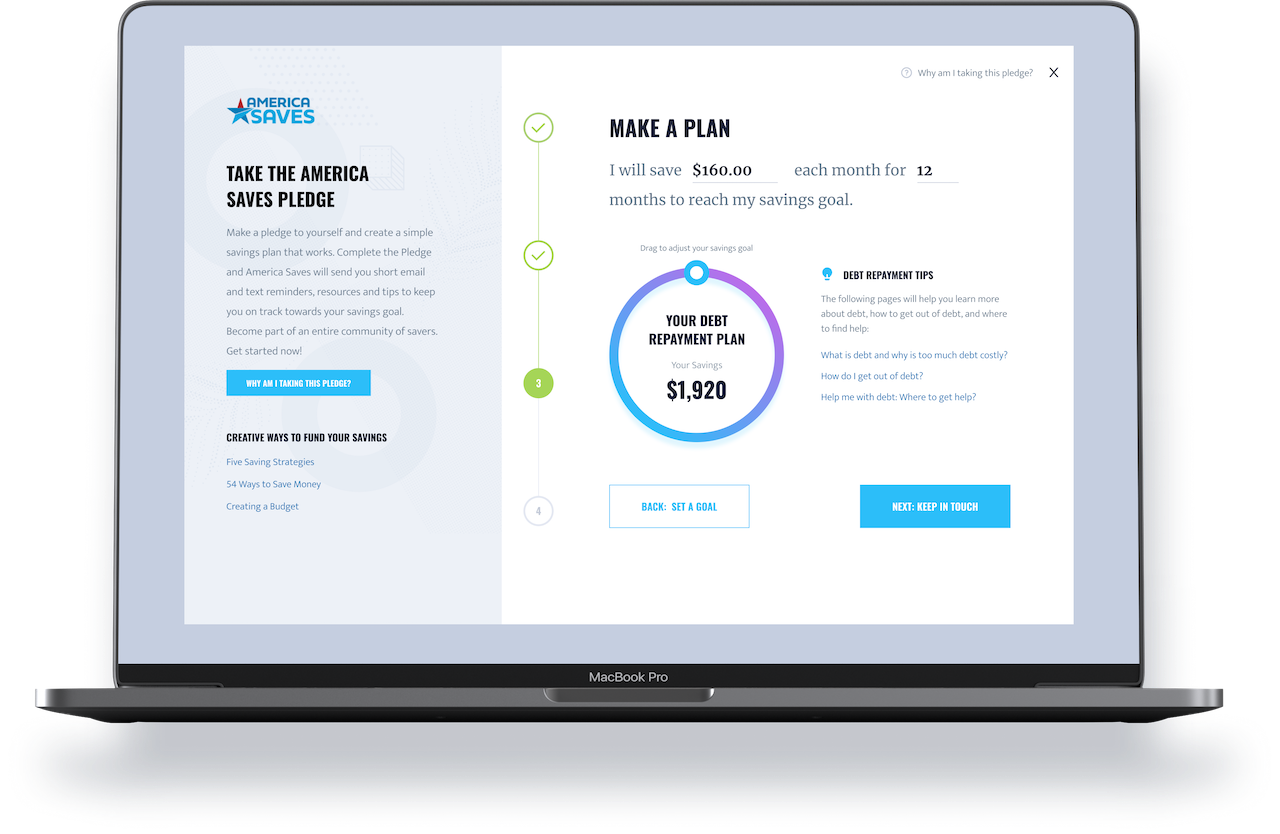

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Veteran Saves will send you short email and text reminders, resources and tips to keep you on track towards your savings goal. Become part of an entire community of savers. Get started now!

creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Veteran Saves Pledge is a pledge to yourself to start a savings journey and Veteran Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Veteran Saves will be right beside you the whole way! You will soon receive an email from the America Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

Veterans: Receive Free Financial Coaching and Counseling

We've partnered with the Coordinated Assistance Network to help you get support- no matter your social, economic, demographic or geographic status.

WHAT ARE YOU SAVING FOR?

Think about your most important financial goal right now. Then choose a topic below to explore resources available to support you in making a plan to achieve your goal.

Do you have a saving tip or story you want to share with us?

If we feature you in our newsletter, you get $50.

TAKE THE VETERAN SAVES PLEDGE

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Veteran Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now!

Take the Veteran Saves pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Veteran Saves will send you short email and text reminders, resources and tips to keep you on track towards your savings goal. Become part of an entire community of savers. Get started now!

creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Veteran Saves Pledge is a pledge to yourself to start a savings journey and Veteran Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Veteran Saves will be right beside you the whole way! You will soon receive an email from the America Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

Savings Insights

By Krystel Spell

28 Realistic Ways Veterans Can Save In 2026

Small, smart moves that help you keep more of what you earn.

By Krystel Spell

Veterans: Your 4-Step Money Check-In for 2026

This time of year, everyone’s telling you to set goals, start over, or reinvent yourself. But what if you’re just trying to stay afloat after the holidays?

By Krystel Spell

Tax Time and Financial Stress: What Veterans Should Know

By Krystel Spell

How Veterans Can Make the Most of Their Tax Refund

Make your tax refund work harder for you in ways that support your long term and short term goals.

By Krystel Spell

Veterans: Start 2026 With a Plan That Works for You

Take an honest look at where you’ve been financially and where you want to go in 2026; we're here to help.

By Krystel Spell

The Truth About Military Discounts: When Saving Isn’t Really Saving

For many Veterans and military families, the words “military discount” show up everywhere—on flights, electronics, restaurants, and even online shopping. They can be helpful, but they can also create a false sense of saving.

10.24.2025 By Krystel Spell

When Pay Stops: The 3-Call Plan for Veterans and Military Families

When paychecks pause, stress kicks in fast. But there are real, simple steps you can take right now to protect your finances and your peace of mind.

10.03.2025 By Krystel Spell

Behind on Bills? Here’s What to Do Before It Hits Your Credit

Being behind on bills doesn’t mean you’ve failed. It means you need a plan.

10.01.2025 By Krystel Spell

How to Cancel Sneaky Subscriptions and Start Saving Today

If you’re trying to rebuild your finances after service, pay down debt, or start saving for your next chapter, it's time for a subscription check-in.

10.01.2025 By Kevin Brasler, Consumer's Checkbook

How to Deal with Unexpected Medical Bills

Check out this article to learn practical steps you can take to protect your finances and ease the stress of medical debt.

Our Partners

06.07.2024 By Walmart

Walmart

Our goal is to support veterans and military families during their service and beyond. That’s how we’ve built a culture where veterans feel they belong, with benefits for their well-being and an understanding that the skills gained in service can transfer to any job out there.

04.24.2023 By VBBP

Veterans Benefits Banking Program (VBBP)

Veterans and their beneficiaries have more options for receiving VA benefits via direct deposit, as well as access to financial services at participating banks and credit unions.

FOLLOW VETERAN SAVES ON SOCIAL!

Veteran Saves is a program of America Saves and sister program to Military Saves. Our mission is to increases the financial confidence and well-being of American Veterans and transitioning service members so that they can save successfully, reduce debt, and build wealth.

Join the Movement! Receive News and Updates

Sign up here to receive:

- partner resource packets every other month to help you communicate with the public, constituents, and other organizations

- latest research and news from the campaign

- other occasional updates and opportunities