A Financially Confident You Begins Here.

One thing veterans have in common is the experience of unique financial opportunities and challenges. On your journey to becoming more financially stable, having a trusted resource and community that meets you where you are and gives practical, easy-to-implement tips and strategies is a complete game changer. Enter Veteran Saves: your savings accountability partner. Join our community for support with saving successfully, reducing debt, building wealth, and more.

Take the Veteran Saves pledge

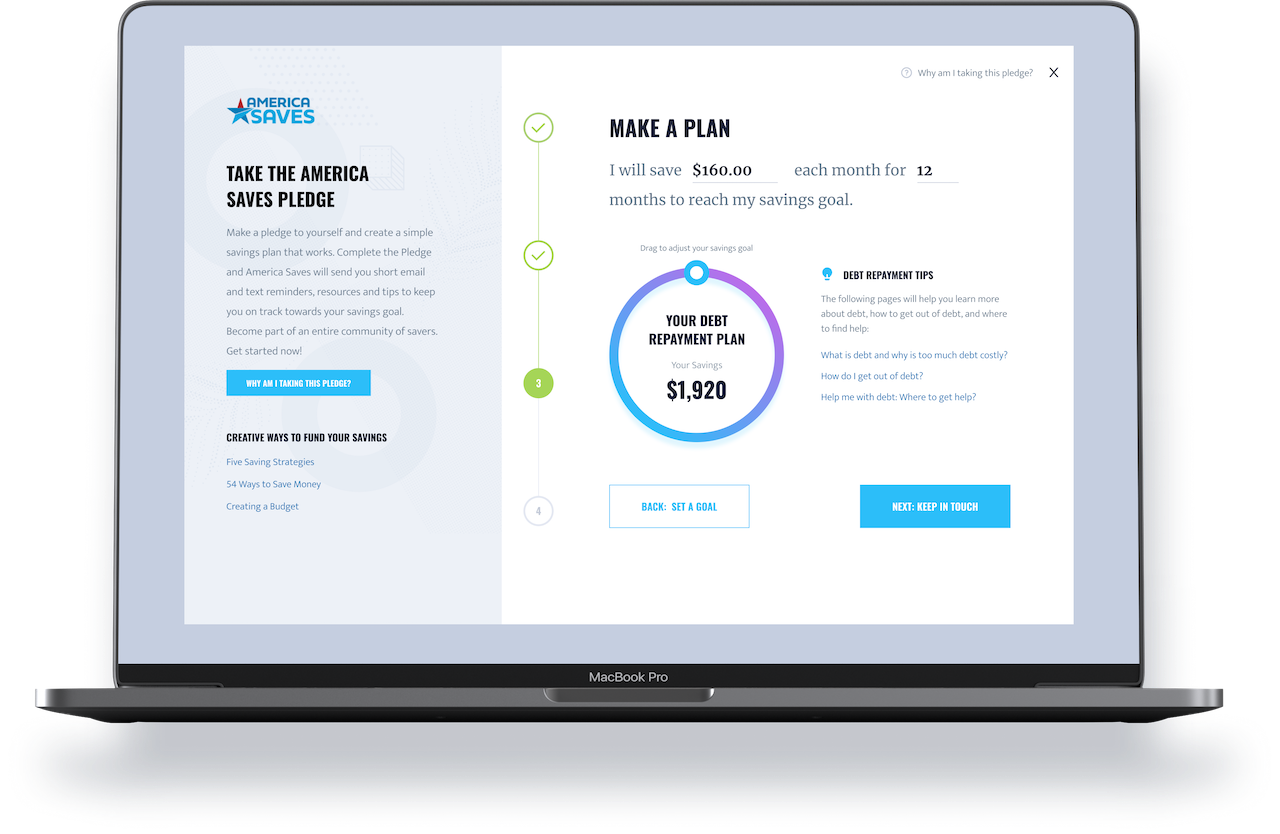

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Veteran Saves will send you short email and text reminders, resources and tips to keep you on track towards your savings goal. Become part of an entire community of savers. Get started now!

creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Veteran Saves Pledge is a pledge to yourself to start a savings journey and Veteran Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Veteran Saves will be right beside you the whole way! You will soon receive an email from the America Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

Veterans: Receive Free Financial Coaching and Counseling

We've partnered with the Coordinated Assistance Network to help you get support- no matter your social, economic, demographic or geographic status.

WHAT ARE YOU SAVING FOR?

Think about your most important financial goal right now. Then choose a topic below to explore resources available to support you in making a plan to achieve your goal.

Do you have a saving tip or story you want to share with us?

If we feature you in our newsletter, you get $50.

TAKE THE VETERAN SAVES PLEDGE

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Veteran Saves will send you short email and text reminders, resources, and tips to keep you on track toward your savings goal. Become part of an entire community of savers. Get started now!

Take the Veteran Saves pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and Veteran Saves will send you short email and text reminders, resources and tips to keep you on track towards your savings goal. Become part of an entire community of savers. Get started now!

creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the Veteran Saves Pledge is a pledge to yourself to start a savings journey and Veteran Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

We are so glad you have started your savings journey and Veteran Saves will be right beside you the whole way! You will soon receive an email from the America Saves team to help encourage you. Find helpful links below to continue researching topics on saving.

Savings Insights

09.02.2025 By Krystel Spell

Using Employer Benefits to Strengthen Your Financial Transition

Transitioning from military to civilian life often means adjusting to a new paycheck, new expenses, and new responsibilities. What many Veterans don’t realize is that civilian employers often provide benefits that can help ease this transition and strengthen long-term financial confidence — if you know how to use them.

09.01.2025 By Krystel Spell

Why Being Banked Matters for Veterans

For many Veterans, managing money looks different after leaving the military. Some continue to rely on cash, money orders, or check-cashing services instead of using a bank or credit union. While that may feel familiar or convenient, staying unbanked or underbanked can come at a cost.

08.29.2025 By Krystel Spell

Survival Mode Spending: When There’s Not Enough

When money is tight, it can feel like every dollar is already spoken for before payday even arrives. For many Veterans and transitioning service members, this reality is all too common. The shift from a steady military paycheck and allowances to the expenses of civilian life can create financial stress that feels overwhelming.

08.28.2025 By Krystel Spell

Financial Steps for Veterans After a Layoff

Losing a job is never easy. For Veterans, the transition out of military service already comes with financial adjustments, and a layoff can make things feel even more uncertain. The good news: while this may feel overwhelming, there are steps you can take right now to protect your financial stability, reduce stress, and set yourself up for what comes next.

08.28.2025 By Krystel Spell

4 Questions to Ask Before Choosing a Bank or Credit Union

Your financial institution should be more than a place that holds your money. It should be a partner you can trust to help you reach your goals, protect your hard-earned dollars, and support you as you move forward in civilian life.

08.01.2025 By Krystel Spell

From Uniform to Workforce: How to Build Emergency Savings Through Your Job

For many Veterans and transitioning service members, building emergency savings can be tough.

07.11.2025 By Krystel Spell

Back-to-School with VA Support: What Chapter 31 (VR&E) Can Help You Pay For

If you’re a Veteran with a service-connected disability and heading back to school, we’ve got good news: the VA’s Chapter 31 Veteran Readiness and Employment (VR&E) program may cover more than just tuition

07.11.2025 By Krystel Spell

39 Practical Ways Veterans and Transitioning Service Members Can Save Money

Saving money after military service or while preparing to transition doesn’t mean living without. It means getting creative, taking advantage of what you’ve earned, and making moves that bring you closer to your goals.

06.16.2025 By Krystel Spell

The Hidden Costs of Relocating After Military Service

So you’re separating or retiring from the military. You’ve got a job lined up (hopefully), maybe a new city in mind, and you’re ready to start your civilian life. But before you pack that last box or schedule the movers, let’s talk about what it’s really going to cost you.

06.12.2025 By Krystel Spell

5 Shifts in Veteran Financial Protections & What It Means for Your Savings

At Veteran Saves, we believe that saving isn’t just about putting money aside, it’s also about having systems in place that help protect your financial progress. Recently, some of those protections have changed, and those changes can directly impact the way Veterans and military families save, borrow, and plan ahead.

Our Partners

06.07.2024 By Walmart

Walmart

Our goal is to support veterans and military families during their service and beyond. That’s how we’ve built a culture where veterans feel they belong, with benefits for their well-being and an understanding that the skills gained in service can transfer to any job out there.

04.24.2023 By VBBP

Veterans Benefits Banking Program (VBBP)

Veterans and their beneficiaries have more options for receiving VA benefits via direct deposit, as well as access to financial services at participating banks and credit unions.

FOLLOW VETERAN SAVES ON SOCIAL!

Veteran Saves is a program of America Saves and sister program to Military Saves. Our mission is to increases the financial confidence and well-being of American Veterans and transitioning service members so that they can save successfully, reduce debt, and build wealth.

Join the Movement! Receive News and Updates

Sign up here to receive:

- partner resource packets every other month to help you communicate with the public, constituents, and other organizations

- latest research and news from the campaign

- other occasional updates and opportunities